17+ nyc mortgage tax

One mill is equal to 1 of tax per 1000 in property value. Web In addition New York City Yonkers and various counties impose local taxes on mortgages that are recorded in those jurisdictions.

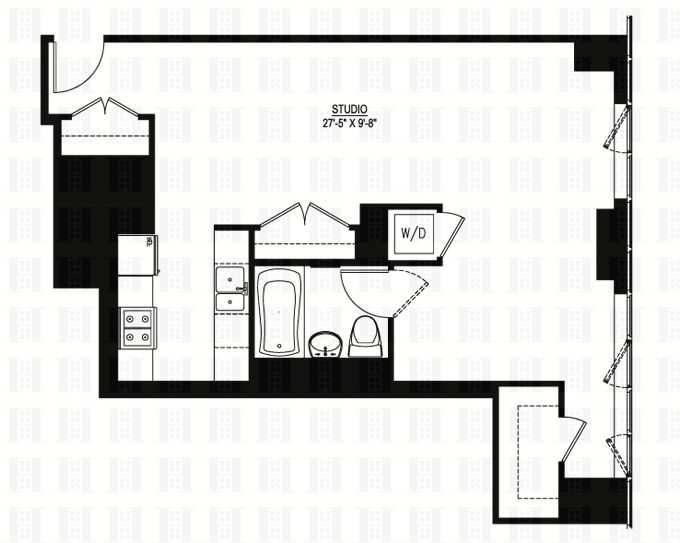

1831 Madison Ave 6m New York Ny 10035 Trulia

Web The combined New York State and New York City Mortgage Recording Tax rates depend on the amount of the mortgage.

. Web 63 rows 2 2175 for all Mortgages of 500000 or more where the premises is a 1 2 or 3 Family Residence or Residential Condominium minus 30 for 1 or 2 Family Dwellings. The following tax rates. For married taxpayers filing separate returns the.

The good news is there are some property tax exemptions for New. Web This mansion tax is based on sales price alone regardless of how big your actual property may be. Get a clear breakdown of your potential mortgage payments with taxes and insurance included.

The tax amount differs on a scale of 1-39 of properties. Web New York tax rates are calculated in millage rates. Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000.

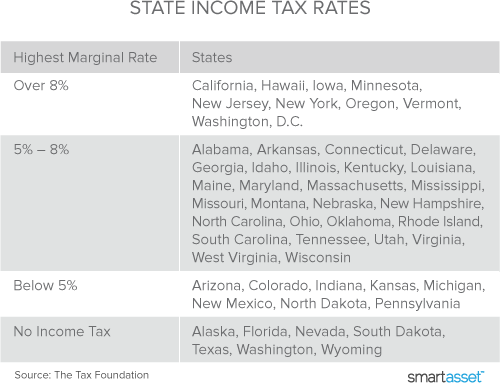

Web If you live in New York City youre going to face a heavier tax burden compared to taxpayers who live elsewhere. Web In NYC the buyer pays a mortgage recording tax rate of 18 if the loan is less than 500000 and 1925 if more than 500000 or more. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017.

These amounts include a New York state levy of. Web Residential properties are taxed at a rate of 050 of the mortgage amount. Web A tax of fifty cents for each one hundred dollars and each remaining major fraction thereof of principal debt or obligation which is or under any contingency may be secured at the.

Thats because NYC imposes an additional local income tax. Web This mortgage calculator will help you estimate the costs of your mortgage loan. Web General mortgage recording tax information For additional information on the mortgage recording tax see TSB-M-962R General Questions and Answers on the Mortgage.

While commercial properties are taxed at a rate of 100 of the mortgage amount. For help calculating the amount of tax due we. Web certain exceptions the rate of the mortgage recording tax varies from a total tax rate of a minimum of 75 to a maximum of 275 for each 100 of the amount secured by the.

4 Granada Crescent Unit 17 White Plains Ny 10603 Trulia

Nyc Mortgage Recording Tax 2023 Buyer S Guide Prevu

How Do I Avoid Mortgage Recording Tax In Ny Updated Nov 2022

1485 5th Ave 14g New York Ny 10035 Trulia

New York Property Tax Strategies Wei Min Tan

Nyc Mortgage Recording Tax 2023 Buyer S Guide Prevu

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium

Nyc Mortgage Recording Tax Nestapple

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium

60 Park Circle White Plains Ny 10603 Mls H6232072 Trulia

20 N Broadway Unit G230 White Plains Ny 10601 Mls H6225185 Trulia

Who Pays Mortgage Recording Tax In Ny Cuddy Feder

Mortgage Interest Tax Deduction Smartasset Com

Nyc Mortgage Recording Tax Guide 2023 Propertyclub

Nyc Mortgage Recording Tax Nestapple

Nyc Mortgage Recording Tax Calculator Interactive Hauseit